CA Modelo 790 2007-2025 free printable template

Show details

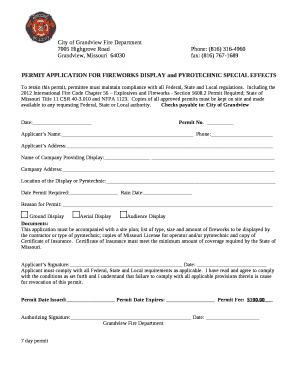

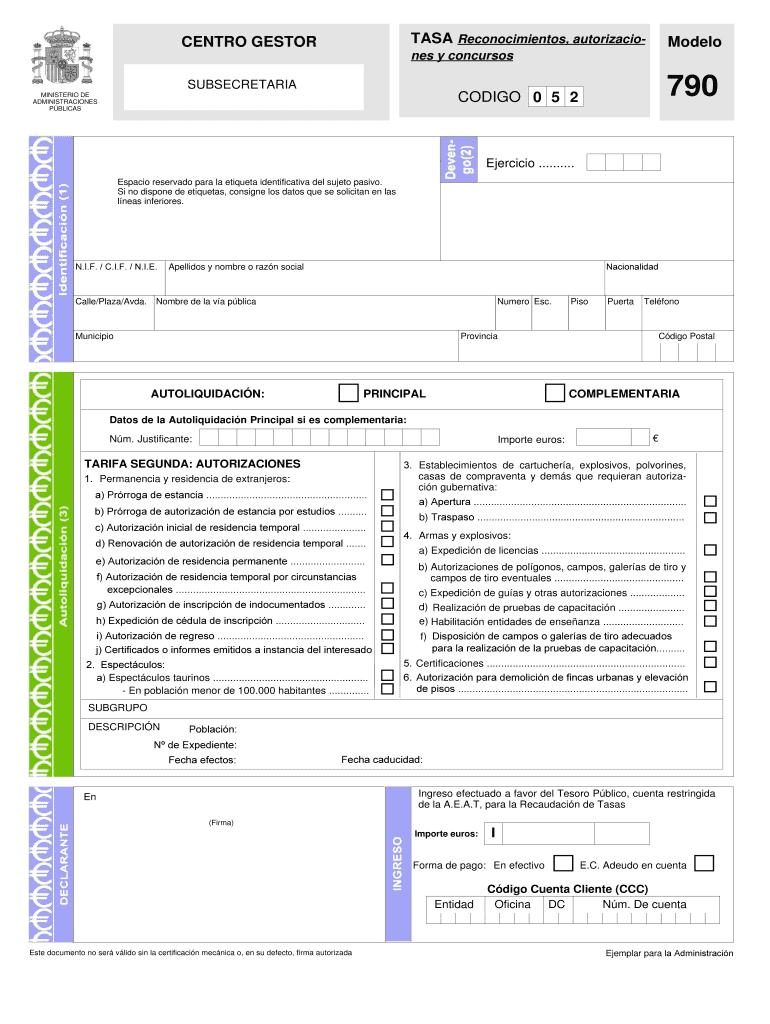

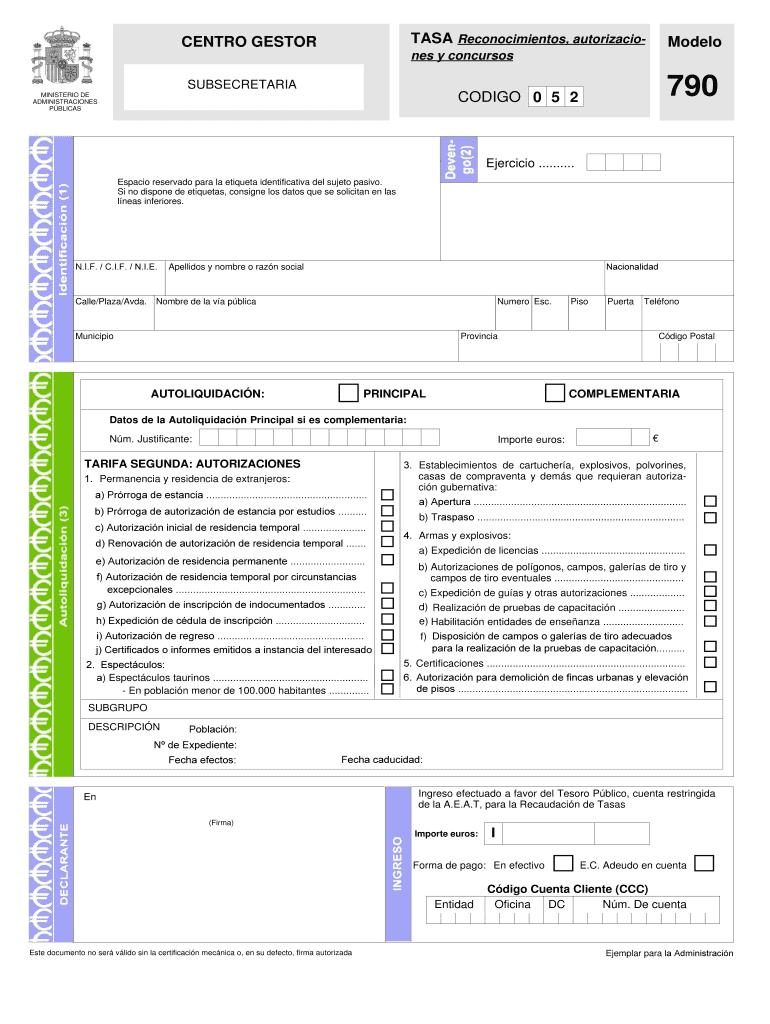

TASK Reconocimientos, authorization- CENTR NESTOR Model ones y concertos 790 SUBSECRETARIA CONGO 0 5 2 MINISTER DE ADMINISTRATIONS P BLOCKS Jericho .......... ESPCI reserved para la etiquette identification

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign modelo 790 c form

Edit your form 790 code 052 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller com form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing modelo 790 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 790 code 052 in english. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

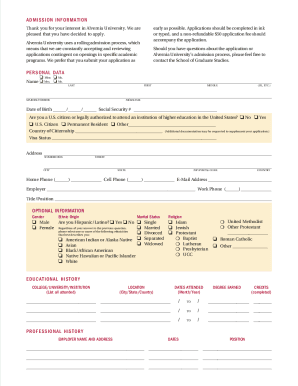

How to fill out modelo 790 pdf form

How to fill out CA Modelo 790

01

Visit the official website of the tax agency or download CA Modelo 790 from the appropriate source.

02

Select the correct type of CA Modelo 790 based on your needs (e.g., for tax payments, certifications, etc.).

03

Fill in your personal details in the designated fields, including your full name, identification number, and contact information.

04

Provide details about the payment or service you are applying for, including amounts and relevant dates.

05

Double-check all entered information for accuracy and completeness.

06

Sign the document if required and ensure you confirm your submission method (online or paper).

07

Submit the form as directed, either electronically or via postal service, following all instructions provided.

Who needs CA Modelo 790?

01

Individuals seeking to make tax payments in Spain.

02

Foreign residents who need to fulfill tax obligations in Spain.

03

Businesses that require specific certifications or payments related to tax procedures.

Fill

form 790

: Try Risk Free

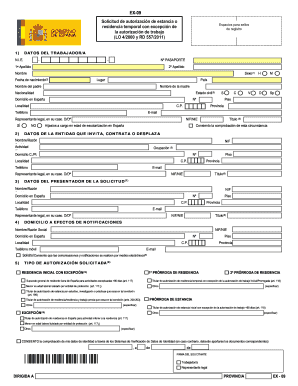

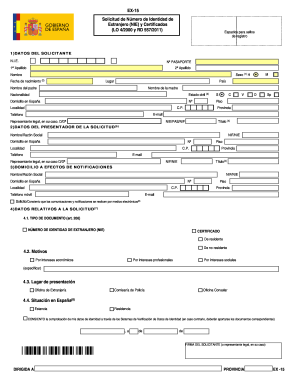

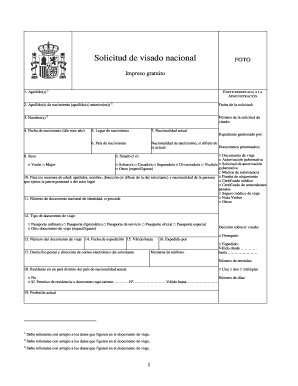

What is modelo 790 centro?

The tax form is called 790-012 and is a standard form used for paying lots of different taxes/fees for immigration matters, so on the form you need to tick the right box for the service you are paying for. This form can now only be filled in online and printed out to take to the bank.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find fill 790 052 form download 40 votes?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 790 spanish form and other forms. Find the template you need and change it using powerful tools.

How do I complete modelo 790 form online?

Easy online 1 pdf email or cloud completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit tasa 790 c straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing 790 052 right away.

What is CA Modelo 790?

CA Modelo 790 is a tax form used in Spain for various administrative procedures, particularly related to tax payments and certain official declarations.

Who is required to file CA Modelo 790?

Individuals and entities required to report transactions or payments relevant to specific taxes, such as property tax or business tax, are mandated to file CA Modelo 790.

How to fill out CA Modelo 790?

To fill out CA Modelo 790, ensure that all required fields are completed accurately, including personal or business identification details, relevant tax information, and the specific purpose for which the form is being submitted.

What is the purpose of CA Modelo 790?

The purpose of CA Modelo 790 is to formalize tax payments, report obligations, and fulfill other administrative requirements set forth by the Spanish tax authorities.

What information must be reported on CA Modelo 790?

CA Modelo 790 requires the reporting of personal or corporate identification data, the type of tax being paid, the corresponding amount, and any relevant details related to the specific transaction or obligation.

Fill out your CA Modelo 790 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

790 052 Form is not the form you're looking for?Search for another form here.

Keywords relevant to download form 790 012 pdf

Related to tasa 790 052 pdf descargar

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.